You have probably heard about the Federal Open Market Committee. You haven’t? Perhaps you saw something about an FOMC meeting? Ok, I know that you know about the Federal Reserve Bank, which goes by the nickname The Fed, or just simply, Fed. Fed officials meet from time to time to discuss, among other things, the state of the economy, how to make it better, and to vote on monetary policy. Is this ringing a bell yet? Of course, it is, these are the folks that have been raising interest rates and making us all miserable with higher monthly credit card, mortgage, and auto loan payments. Not to mention making us downright miserable in our stock portfolios. Aha, now you know who I am talking about. So, who is this FOMC and what exactly do they do?

Federal Open… what?

The Federal Open Market Committee, also known as the FOMC, is a division of the Federal Reserve System, and its primary responsibility is to set Monetary Policy. Remember that “The Government” attempts to control the US economy through Fiscal Policy and Monetary Policy. Fiscal Policy is directed by the Executive and Legislative branches and typically deals with spending money to stimulate the economy and taking it away to slow the economy. Spending money can involve tax cuts or even direct payments such as the COVID stimulus payments. Taking away money can involve tax increases or costly regulations.

Monetary Policy, on the other hand, is controlled by the central bank, The Fed. The Fed can stimulate or dampen economic growth by controlling the money supply. The central bank also controls interbank lending rates which it can adjust in order to control broader interest rates. Lower interest rates stimulate the economy while higher interest rates slow economic growth.

While Monetary Policy is more tactical in nature, Fiscal Policy is considered more strategic. Monetary policy can change any day of the year, while most modifications to Fiscal policy require Congress to pass legislation. I will resist the urge to lampoon the process, but it is indeed more challenging to get both chambers of Congress and the President to agree and sign off on policy changes… especially when it includes money. Despite this, Fiscal Policy can be enacted quickly in emergency situations such as war or… a pandemic. For this newsletter, we will focus on Monetary Policy, as it is very much a top-of-mind challenge for most of us. So, now that we know about who controls Monetary Policy, let’s get into some more detail.

Who are these people? What are these people?

The committee is made up of 12 members and is made up as follows. Bear with me… please. There are 7 members of the Board of Governors. Each of them gets a vote on the FOMC. In addition, the President of the New York Fed always gets a vote… sorry non-New Yorkers, I didn’t make the rules. The remaining 4 voting members are Presidents from the remaining 11 regional Fed banks, but they rotate, one regional Fed president from each of the following groups.

1. Boston, Philadelphia, and Richmond

2. Cleveland and Chicago

3. Atlanta, St. Louis, and Dallas

4. Minneapolis, Kansas City, and San Francisco

Members from the rotation group serve 1-year terms and fully rotate every three years… except for group 2… it’s just math. The Governors’ Board is made up of the Chair, Vice-Chair and 5 independent Governors. The reason I bring this up is because you will sometimes read that a FOMC member made a comment but he or she is a “non-voting” member, meaning that they participate in analysis and discussions, but they do not get to vote on policy. As you probably are well aware, the committee members are quite vocal, despite their “voting” status, so it is important to pay attention.

The Current group of voting FOMC Members are as follows:

- • Jerome Powell – Chair of the Federal Reserve

- • Lael Brainard – Vice-Chair of the Federal Reserve

- • Michelle Bowman – Fed Governor

- • Lisa Cook – Fed Governor

- • Philip Jefferson – Fed Governor

- • Christopher Waller – Fed Governor

- • Michael Barr – Fed Governor

- • John Williams – New York Fed President

- • James Bullard – St. Louis Fed President

- • Susan Collins – Boston Fed President

- • Esther George – Kansas City Fed President

- • Loretta Mester – Cleveland Fed President

Ladies and gentlemen, I give you, the 12 of the most powerful people in the World.

Know your animals – a field guide

You have most likely heard of Fed members being described as Hawks or Doves. Hawks have a historic penchant for voting for more restrictive policies while Doves have a historic predilection for accommodative policy. In layman’s terms, Hawks favor higher interest rates and Doves, lower. The current voting members are classified as follows

- • Dovish – Brainard, Cook

- • Centrist – Powell, Williams, Jefferson, Barr, Collins

- • Hawkish – Mester, Bowman, George

- • Very hawkish – Bullard, Waller

It is important to note however, that members, unlike most real animals, can change their stripes. Economic conditions change… and so does political pressure. On that note, Senior Fed officials are selected from the members by the President and confirmed by the Senate. They serve 14-year terms, and yes, members can be fired with cause. While the group is intended be apolitical, it is clear that appointments and confirmations may be influenced by political actors. However, once a member is duly appointed and confirmed, politicians can only pressure members from the bully pulpit.

Most of the members have exceptional careers in banking, economics, and academia. You are not likely to find a wealthy captain of industry on the FOMC, hence the many jokes about thick glasses and pocket protectors that seem to buzz around the group.

What exactly do these powerful number-crunchers do?

Being on the FOMC is a full-time job. The committee meets 8 times a year to formally discuss and vote on policy. However, as aforementioned, the FOMC can make extra-meeting policy changes, though it is not the norm. At those meetings, members are expected to share their economic projections along with their policy positions. After all those presentations and discussions, the voting members do, in fact, vote on policy changes. Yeas and nays. Those are recorded and reported. That is how we know member’s true “stripes”. All of the discussions between members that lead to the vote are summed up and released as meeting minutes 3 weeks after policy is decided on. Fed watchers like to parse those discussions to get more color on the direction of the committee. That allows the Fed to more effectively communicate its policy wishes to the markets. The meeting minutes, after all, are intended for public consumption.

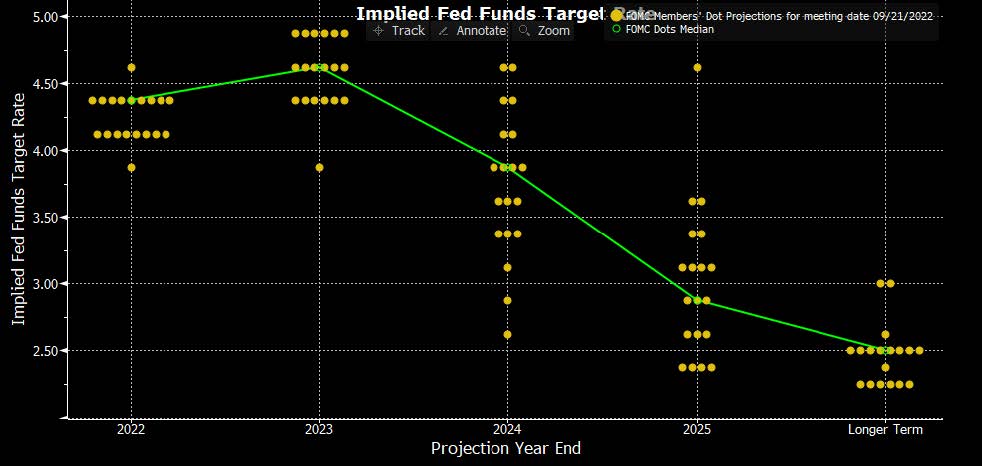

Once each quarter the Fed releases its Summary of Economic Projections which include each member’s individual projection for things like GDP, inflation, unemployment, and of course, interest rates. The projections are anonymous, so we are not privy to which member is attached to which projection, but it does allow us to see how the overall median projection is distributed. Also included in the Summary is the FOMC’s now-popular Dot Plot (shown below) which shows all 19 Fed members’ Fed Funds Rate projections, voting and non-voting. On the chart, the green circle is the median of those projections, which is typically what is quoted in the media. But if you look at the Dot Plot itself you can get a sense of how the members’ opinions vary. For example, in the chart below we can see that the members, on median, expect Fed Funds to end this current year just below 4.5%, with most of the members leaning to the lower side, so 4.25% is not unlikely. Next year’s projection is only slightly higher with also tight distribution. In 2024 and 2025, you can see that the projections vary widely, and they are expected to change over time. Members even log projects for the longer term beyond the next three years. On this, I will refer to a 1918 quote by John Maynard Keynes, the father of modern economics.

But this long run is a misleading guide to current affairs. In the long run we are all dead.

All that aside, it is wise for not just investors, but also all of us to understand what those powerful bankers are thinking. From this plot we see clearly that the Fed expects to taper off its hiking sometime next year and to possibly even lower interest rates in 2024. We can’t count on that until those dots tighten up a bit. Ok, so once the FOMC votes on policy, what does it do with all the facts, figures, and cast votes?

Operations

Of course, the Fed can just change statutory rates. An example might be changing a bank reserve requirement or the discount rate, but most policies require the central bank to actually go into the open market to effect material changes. Let’s start with the Fed Funds Rate. That is the overnight lending rate charged between banks and it is one of the Fed’s most powerful tools. The FOMC will vote on a Fed Funds Target, though that target is typically achieved by the Fed raising the bank reserve requirement. If a bank has higher reserve requirements it is more likely to borrow overnight from other banks to meet the requirements. The higher demand for a Fed Funds loan will push the rate higher. Higher borrowing costs for the banks find their way into loans which it makes to companies in the form of commercial loans or even to average consumers in the form of mortgages. Indirect, yes, but effective? Definitely.

You may have heard the term Money Supply. That is quite literally the supply of money available to the public, and guess who controls that? The Fed, of course. The Fed can increase or decrease the money supply to affect interest rates! If the Fed wants to tighten monetary policy by raising rates, one of its tools to accomplish this is to remove liquidity from the system. That is to say, it will lower the money supply. Because there is less money available for those who want to borrow it, the price of borrowing will go up, and that price is… interest rates. Makes sense, right? But how does the Fed simply remove money from the money supply?

Can someone show me where the drain is?

The Fed can drain liquidity, or cash, from the economy by simply selling bonds. When banks and dealers buy bonds from the Fed, the money paid is removed from the money supply. The Fed has been doing just that as it winds down its balance sheet. That is referred to as a Permanent Open Market Operation.

As you might guess, the money supply is… er, quite large, and that means that there are plenty of adjustments that must be made on a daily basis to keep the ship on course, so to speak. To do that, the Fed conducts Temporary Open Market Operations. In those, the Fed uses repurchase agreements (repos) and reverse repurchase agreements (reverse repos or match sales). A repo agreement involves the sale of securities, in this case treasury bonds, which it agrees to buy back on a specific date. So, if the Fed conducts open market repos, it is removing liquidity (shrinking the money supply) TEMPORARILY, until it buys the securities back at a future date. The opposite is true for a reverse repo operation.

That really is a full-time job

In addition to monitoring the economy and setting policy, already quite a bit of work, the FOMC is also responsible for all the open market operations (also known as OMOs) to put those policies into effect. As you probably suspect by now, keeping inflation in check while maintaining a healthy labor market is not as simple as it sounds. Further, raising and lowering interest rates, in and of itself, is a herculean undertaking. While it may be true that we are all dead in the long run, it is the FOMC’s job to get us to that long run in one piece. It takes the work of a group of extraordinarily powerful… and hard-working bankers who sit on the Federal Open Market Committee, a division of the larger US Federal Reserve.

IMPORTANT DISCLOSURES.

Muriel Siebert & Co., LLC is an affiliated broker/dealer of the public holding company, Siebert Financial Corporation, which also owns Siebert AdvisorNXT, LLC. Siebert AdvisorNXT, LLC is a registered investments advisor (RIA) with the SEC and with state securities regulators. We may only transact business or render personal investment advice in states where we are registered, filed notice or otherwise excluded or exempted from registration requirements. Investment Advisor products are NOT insured by the FDIC, SIPC any federal government agency or Siebert’s parent company or affiliates.

You are being provided this Market Note for general informational purposes only. It is not intended to predict or guarantee the future performance of any security, market sector or the markets generally. This Market Note does not describe our investment services, recommendations or market timing nor does it constitute an offer to sell or any solicitation to buy. All investors are advised to conduct their own independent research before making a purchase decision. This Market Note is to provide general investment education and you are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate for you based on certain investment objectives and financial situation. Do not use the information contained in this email as a basis for investment decisions. You should always consult your investment advisor and tax professional regarding your investment situation before investing. The charts and graphs are obtained from sources believed to be reliable however Siebert AdvisorNXT does not warrant or guarantee the accuracy of the information. Any retransmission, dissemination or other use of this email is prohibited. If you are not the intended recipient, delete the email from your system and contact the sender. This is a market commentary, not research under FINRA Rule 2210 (b)(1)(D)(iii) and FINRA Rule 2210 (c)(7)(C).

© 2021 Siebert AdvisorNXT All rights reserved.