Equities rallied yesterday as investors finally got up the courage to buy stocks on sale. Corporate earnings are rolling in, and so far, so good, but we have a long, long way to go.

Just get good with it. In Ronald Dahl’s 1964 classic Willie Wonka and the Chocolate Factory, his infamous antagonist Veruca Salt utters her iconic “I want it now!” What does she want? Another pony, more chocolates, parties, gooses, geeses… never mind, she wants the world… and she wants it…. NOW. I get the feeling, sometimes, that stock traders have picked up a bit of Veruca’s spoiled attitude.

Now, now, I understand that time is money, and money is the reason why we are even here, in the market that is. But sometimes, just like our wise, sagely elders taught us as kids, it takes patience! I am going to ask you a question. So what, if the Fed doesn’t lower interest rates in the summer? I know that’s a loaded question and it has different implications to different people. But as a stock market investor who has done diligence and positioned stocks that have great potential with top-notch management, what does a -25 basic-point rate cut in June or July… or September really mean to you? I know that some companies rely heavily on interest rate sensitive financing, but what about the ones that don’t? What about the ones whose management has not signaled that interest rates are a problem for profits? Hmmm? Exactly.

The Fed is waiting for inflation to come back down to its target of +2%. Inflation is not quite there yet and based on the voodoo math in yesterday’s market note, it may even tick up a notch before pulling back down to trend toward normalcy. Never mind the fancy math, we know that the last remaining holdout on inflation is services, and more specifically, shelter costs… AKA rent. Now, real estate is one of those sectors that very much DOES rely on interest rates. When the Fed raises the Fed Funds rate, banks hike their lending costs, and higher lending costs for real estate investors means lower profits UNLESS rents go up faster than borrowing costs. I am sure that is all well understood by all of you. However, there is one thing that we have not discussed yet: time. Interest rates were almost 0% for a long, long time and real estate investors took full advantage of them with record borrowing and investing. But not unlike you and me who lock in rates for a longer period of time, real estate investors are still sitting on loans with lower interest rates, and the higher rents that most are charging are only giving them greater profit… for now. When those loans mature however, things are going to get spicy for them, but for the already-high rents they charge. In many cases, those real estate investors will be pushed to dump their investments once those loans mature. Many of those investors are on the edges of their seats as a great deal of those loans are scheduled to mature over the next 12 to 18 months. That reset, which is likely to involve bankruptcies, followed by a real lowering of interest rates is the only way for rent inflation to moderate. AND IT WILL… eventually.

You see rates were really low for an unprecedented amount of time, and therefore it is reasonable to expect that the effects of the only recently higher interest rates will take some time to take full effect. Just know that it WILL happen, maybe just not NOW. That said, the Fed is pressing its luck for as long as it can, knowing full well that rates at these levels are, indeed restrictive, even according to the Fed’s kind-of gospel Taylor Rule. It knows that rates must come down at some point soon to avoid pushing the rest of the economy into a messy mess. Once again it took many years of near-zero interest rates, AND THE SUPPLY SHOCKS OF THE PANDEMIC to get us here, and so it is reasonable to assume that it may take some time to reverse the effects.

We know that some industries rely heavily on credit to conduct business. Growth stocks are not capital intensive and, for the most part, do not rely on low interest rates for profits. To be clear, all companies use credit in one way or another, but some are far less reliant than others. Now unless the CEO of your favorite growth company announces during earnings that higher interest rates are hampering the business, I would suggest that, maybe you should be less worried about the long-term effects of Fed Funds rates that may be -25 basis points lower, or even higher in one month versus the following month. Now, if that CEO tells us that regardless of interest rates, competition is causing the company’s sales growth to wane, you should probably check your investment thesis and make sure it is still valid. Remember it has nothing to do with interest rates. Are they selling fewer smart phones for some reason? Are they selling less cars? Will lower interest rates help? Those are the questions we should be asking ourselves. Will the Fed lower interest rates? Sure, eventually. I know you want it NOW, but you are just going to have to be patient. You don’t want to end up like Veruca, who in the book is pushed down a garbage chute by squirrels, after judging her to be a bad nut. Don’t be a bad nut 🐿️🐿️.

GOOD NUTS AND BAD NUTS IN THE PREMARKET

The Sherwin-Williams Co (SHW) shares are lower by -6.72% after the company announced that it missed EPS and Revenues by -2.31% and -2.57% respectively. On a positive note, the company reaffirmed its full-year guidance. The company’s 27x forward PE is higher than the 26.92x median of its peer group. Dividend yield: 0.92%. Potential average analyst target upside: +10.7%.

Danaher Corp (DHR) shares are higher by +6.74% in the premarket after the company announced that it beat on EPS and Sales by +12.37% and +3.05% respectively. In the past month, 7 analysts have raised their price targets while 1 has lowered. Dividend yield: 0.45%. Potential average analyst target upside: +13.8%.

ALSO, this morning: PepsiCo, JetBlue, GM, PulteGroup, Halliburton, RTX, Kimberly-Clark, Philip Morris, Lockheed Martin, and Fiserv all beat on EPS and Revenues while UPS, MSCI, Invesco, and GE came up short.

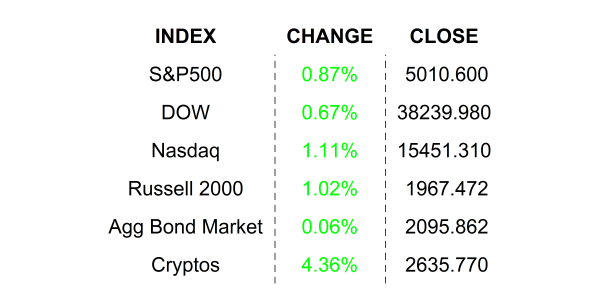

YESTERDAY’S MARKETS

NEXT UP

- S&P Global Flash US Manufacturing PMI (April) is expected to have inched up slightly to 52.0 from 51.9.

- S&P Global Flash US Services PMI (April) may have increased to 52.0 from 51.7.

- New Home Sales (March) are expected to have increased by +0.9% after slipping by -0.3% in February.

- Earnings announcements after the closing bell: Baker Hughes, Steel Dynamics, Enphase Energy, CoStar Group, Texas Instruments, Tesla, and Visa.

IMPORTANT DISCLOSURES.

Muriel Siebert & Co., LLC is an affiliated broker/dealer of the public holding company, Siebert Financial Corporation, which also owns Siebert AdvisorNXT, LLC. Siebert AdvisorNXT, LLC is a registered investments advisor (RIA) with the SEC and with state securities regulators. We may only transact business or render personal investment advice in states where we are registered, filed notice or otherwise excluded or exempted from registration requirements. Investment Advisor products are NOT insured by the FDIC, SIPC any federal government agency or Siebert’s parent company or affiliates.

You are being provided this Market Note for general informational purposes only. It is not intended to predict or guarantee the future performance of any security, market sector or the markets generally. This Market Note does not describe our investment services, recommendations or market timing nor does it constitute an offer to sell or any solicitation to buy. All investors are advised to conduct their own independent research before making a purchase decision. This Market Note is to provide general investment education and you are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate for you based on certain investment objectives and financial situation. Do not use the information contained in this email as a basis for investment decisions. You should always consult your investment advisor and tax professional regarding your investment situation before investing. The charts and graphs are obtained from sources believed to be reliable however Siebert AdvisorNXT does not warrant or guarantee the accuracy of the information. Any retransmission, dissemination or other use of this email is prohibited. If you are not the intended recipient, delete the email from your system and contact the sender. This is a market commentary, not research under FINRA Rule 2210 (b)(1)(D)(iii) and FINRA Rule 2210 (c)(7)(C).

© 2021 Siebert AdvisorNXT All rights reserved.