Stocks suffered another weaker session, with a marginally mixed close. Early gains could just not stick and all attempts at recovery were thwarted – a sign of technical weakness.

Conflict. I am not going to go on a long diatribe about how crude oil is so important to today’s economy. You know my thoughts on that, loyal readers. Therefore, you were probably not surprised when the current conflict in the middle east erupted with the Hamas attack on Israel, many were calling for oil to shoot through the roof and cause widespread economic calamity. As weeks and months went by, more and more countries were drawn into the conflict. A few days ago on April 13th, Iran launched an unprecedented attack directly on Israel, launching hundreds of drones and missiles. This event was sure to push the region into a broader conflict as Israel prepared to retaliate. This morning, WHILE YOU SLEPT, reports surfaced that Israel launched a limited missile attack on Iran and details are still emerging. This sad state of affairs has dominated the news these past many months, and you may be wondering what effect all this may have had on your portfolio. Let’s dig in and see.

First, let’s see how crude oil reacted to this morning’s news that Israel launched a limited attack on Iran. Check out the following chart.

I have been monitoring this all morning, but as of the time I plotted this chart of crude futures, they are net down by -3.6%, but you can clearly see the spike that occurred as the news broke with crude prices reaching as high as 86.24. Perhaps as details emerge of the limited scope and damage, markets are settling down.

Now let’s take a wider look and see how crude performed since the Hamas terrorists launched their attack on Israel last October. Check out the following chart to see.

On this chart, we can see that crude trended lower in the wake of the Hamas attack, but as the conflict broadened and tensions rose, crude climbed back into the 80s peaking at 91.17 in the first week of April. Was it the crisis that caused crude to climb since last December? Let’s take a look at OPEC production in that period for some clues. Have a look.

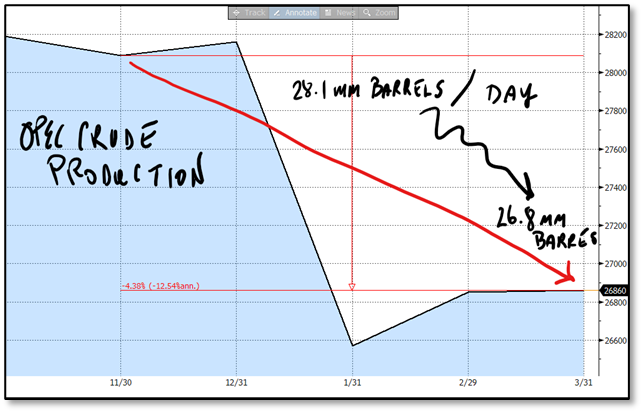

You can see by this chart that crude supply declined by -4.38% over that period, which is a strong driver of oil’s price increase. Remember, less supply, higher prices 😉. Now, bear with me. Just 2 more charts and you will be in the know. This next chart shows the breakdown of OPEC crude production across member states.

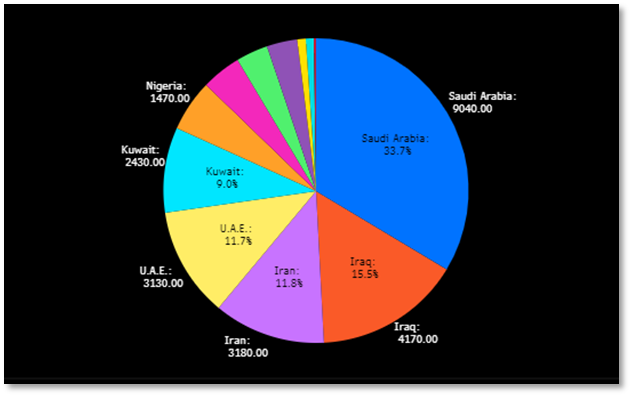

On the pie chart, you will notice that Iran represents almost 12% of OPEC’s 26.8 million daily barrels produced per day. That is not a small number, and one would expect that the conflict would have also had an upward impact on crude prices over the past several months as it is, unarguably at the center of the crisis. Last chart, I PROMISE. Have a look and then follow me to the close.

So, what did we learn with all these pictures today? Since Hamas terrorists first attacked Israel, the price of crude oil actually declined slightly. The price of crude would possibly be even lower if crude production did not decline during the same period. It has long been feared that a broader conflict spurred by a direct conflict between Iran and Israel would cause crude to spike and cause chaos in global capital markets. Iran’s unprecedented attack on Israel last week and Israel’s response early this morning has done very little to influence the price of oil. As geopolitical tensions boil over, markets should have, in theory, factored in the risk with muted, if not negative returns. In fact, the S&P 500 gained some +21% since the Hamas attack through the Fed’s March 20th FOMC meeting, after which it declined by -4.3%, as interest rates spiked in response to Fed rhetoric on the pace of rate cuts. The bottom line is that the conflict has had very little net effect on overall equity markets. Now you know.

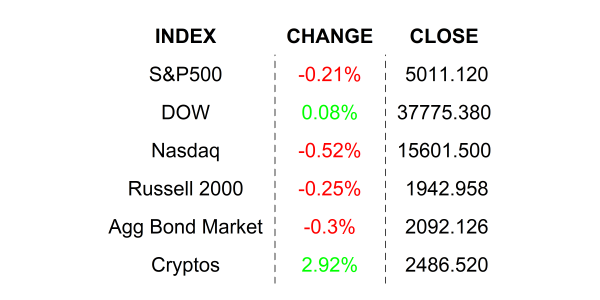

YESTERDAY’S MARKETS

NEXT UP

- Chicago Fed President Austan Goolsbee will speak.

- Next week: lots of earnings in addition to flash PMIs, housing numbers, Durable Goods Orders, GDP, Personal Income, Personal Spending, PCE Deflator, and University of Michigan Sentiment. Check back in on Monday to download calendars and details.

IMPORTANT DISCLOSURES.

Muriel Siebert & Co., LLC is an affiliated broker/dealer of the public holding company, Siebert Financial Corporation, which also owns Siebert AdvisorNXT, LLC. Siebert AdvisorNXT, LLC is a registered investments advisor (RIA) with the SEC and with state securities regulators. We may only transact business or render personal investment advice in states where we are registered, filed notice or otherwise excluded or exempted from registration requirements. Investment Advisor products are NOT insured by the FDIC, SIPC any federal government agency or Siebert’s parent company or affiliates.

You are being provided this Market Note for general informational purposes only. It is not intended to predict or guarantee the future performance of any security, market sector or the markets generally. This Market Note does not describe our investment services, recommendations or market timing nor does it constitute an offer to sell or any solicitation to buy. All investors are advised to conduct their own independent research before making a purchase decision. This Market Note is to provide general investment education and you are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate for you based on certain investment objectives and financial situation. Do not use the information contained in this email as a basis for investment decisions. You should always consult your investment advisor and tax professional regarding your investment situation before investing. The charts and graphs are obtained from sources believed to be reliable however Siebert AdvisorNXT does not warrant or guarantee the accuracy of the information. Any retransmission, dissemination or other use of this email is prohibited. If you are not the intended recipient, delete the email from your system and contact the sender. This is a market commentary, not research under FINRA Rule 2210 (b)(1)(D)(iii) and FINRA Rule 2210 (c)(7)(C).

© 2021 Siebert AdvisorNXT All rights reserved.