Stocks had another rough session yesterday as traders come to grips with a Fed that is in no rush to make life easier. The Fed’s Beige Book was filled with stories of moderate growth, supporting both sides of the rate-cut debate.

Draconian measures. Tariffs are those things that you learn about in high school history class and for about 10 minutes in your university freshman microeconomics class… and for about another 90 minutes in your university sophomore international economics class… and that’s it. Do you remember learning about “The Tariff of Abominations” in 1828, or the 1930 “Smoot-Hawley Tariff?” You must remember the chicken wars between the US and Europe that kicked off the chicken tariffs of the 1960s. Did I jar any memories? Of course, I didn’t. Tariffs are unpopular and not often used… and there is a reason for that.

I am sure that you are raising your hand, eagerly leaning over your desk to tell the class that your most prominent memory of tariffs was from 2018, just a few years ago. Good job, and you are correct. The Trump Administration famously kicked off a trade war with China and the weapon of choice, for both sides, was the tariff. It was not just China that was targeted, but the EU as well. Tariffs were also imposed on Canada and Mexico. Leveling the trade playing field using tariffs became the rai·son d’ê·tre of the US. The Biden Administration continued the effort, even adding teeth with additional trade restrictions, principally focused on China.

I am a history buff, but I am also a trained economist, so today, I am going to put on my economist professor’s mortar board 🎓. If you are a regular, long-time reader, you may recall my writings on this during the 2018 US-China Trade War. The effects of the tariff were similar, but they had different implications. Get out your notebooks.

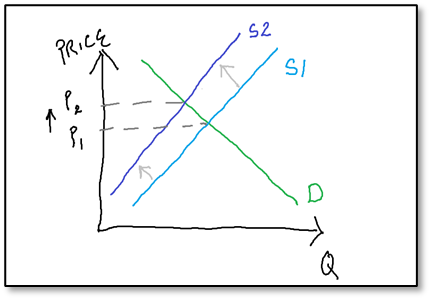

When one exacts a tariff on imports of raw materials, it is the equivalent of increasing production cost. If domestic producers’ costs are higher, they will, naturally, pass those prices along to consumers. That is classic supply-push inflation. Another classic is the impact on supply and demand. If imports of goods are reduced due to sanctions, the supply curve shifts to the left (S1 to S2) causing equilibrium prices to rise (P1 to P2). Here is my chicken scratch sketch of that classic.

Trade sanctions are typically imposed to protect domestic producers by eliminating foreign competition with cheaper goods. Go ahead, re-read that last statement. It makes sense, doesn’t it? Eliminate foreign competition from dumping cheap products in the domestic market. While that may help domestic producers, unfortunately it will come at a cost to domestic consumers. With less competition, producers are able to charge higher prices, which, if they are rational, they certainly will. There is a different supply and demand curve diagram for that, but I will spare you from having to copy it down; simply remember that the result is upward price pressure. Finally, tariffs and trade wars cause supply disruptions. Do you remember what happened last time we had a supply disruption? That’s right, supply-shock driven inflation.

Now, I know that, like everything else in finance, the markets, and economics, there are two sides to every story. Administration officials, most of them far smarter than me, can draw far more complex charts. One might even show that tariffs which cause decreased demand for foreign products will cause the domestic currency to strengthen, which ultimately has the effect of making purchasing foreign goods… cheaper, thus offsetting inflationary pressure. Hmm. There are plenty of others, but suffice it to say that most economists would agree that tariffs are generally not good for domestic inflation. As I implied earlier, inflation was not a problem during Trump’s presidency, but now… um, it’s a real problem. Not only that, as far as markets are concerned, we are at a real inflection point with interest rates (in case you haven’t noticed), which are almost entirely dependent on… inflation. It would seem that we might want to tread lightly on this one.

Sorry to get technical on you today. Don’t worry, this won’t be on the quiz, but I want you to remember that tariffs, in general, are inflationary. They can serve to benefit domestic producers… but only at a cost to… consumers.

UPS AND DOWNS BEFORE THE BELL

Blackston Inc (BX) shares are lower by -1.98% in the premarket after it announced that it beat EPS and Revenue estimates. The cause for the drop is fund inflows which came in at $34.04 billion when the median of analysts’ estimates is $39.9 billion. In recent weeks 9 analysts have raised their price targets while 2 have lowered them. Dividend yield: 3.05%. Potential average analyst target upside: +4.9%.

DR Horton Inc (DHI) shares are higher by +2.58% after the company announced that it beat EPS and Revenue estimates by +14.77% and +10.03% respectively. The company raised its full year guidance beyond analysts’ expectations based on strong demand and continued, constrained supply. The companies 10.30x forward PE is greater than the 8.9x median of its peers. Dividend yield: 0.82%. Potential average analyst target upside: +15.2%.

This morning small cap volume breakout: 23andMe Holding Co (ME) shares are higher by +23.44% on high volume after the company’s CEO reported that she is considering making a proposal to take the company private. Potential average analyst target upside: +244.4%. *This is a small cap company with coverage of only 2 analysts, so treat this information with caution.

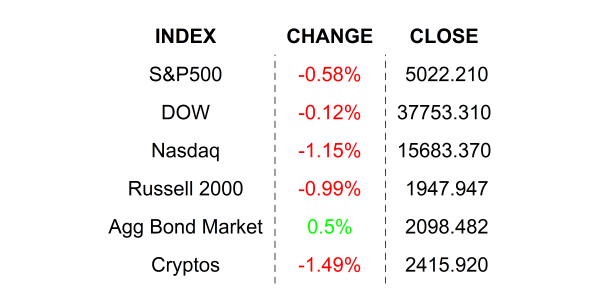

YESTERDAY’S MARKETS

NEXT UP

- Initial Jobless Claims (April 13) is expected to come in at 215k, slightly higher than last week’s 211k.

- Leading Economic Index (March) is expected to have slipped by -0.1% after gaining +0.1% in February.

- Existing Home Sales (March) may have declined by -4.1% after gaining +9.5% in the prior month.

- Fed speakers today: Bowman, Williams, Bostic, and Collins.

- After the closing bell earnings: Intuitive Surgical, Netflix, PPG Industries, and Western Alliance Bancorp.

IMPORTANT DISCLOSURES.

Muriel Siebert & Co., LLC is an affiliated broker/dealer of the public holding company, Siebert Financial Corporation, which also owns Siebert AdvisorNXT, LLC. Siebert AdvisorNXT, LLC is a registered investments advisor (RIA) with the SEC and with state securities regulators. We may only transact business or render personal investment advice in states where we are registered, filed notice or otherwise excluded or exempted from registration requirements. Investment Advisor products are NOT insured by the FDIC, SIPC any federal government agency or Siebert’s parent company or affiliates.

You are being provided this Market Note for general informational purposes only. It is not intended to predict or guarantee the future performance of any security, market sector or the markets generally. This Market Note does not describe our investment services, recommendations or market timing nor does it constitute an offer to sell or any solicitation to buy. All investors are advised to conduct their own independent research before making a purchase decision. This Market Note is to provide general investment education and you are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate for you based on certain investment objectives and financial situation. Do not use the information contained in this email as a basis for investment decisions. You should always consult your investment advisor and tax professional regarding your investment situation before investing. The charts and graphs are obtained from sources believed to be reliable however Siebert AdvisorNXT does not warrant or guarantee the accuracy of the information. Any retransmission, dissemination or other use of this email is prohibited. If you are not the intended recipient, delete the email from your system and contact the sender. This is a market commentary, not research under FINRA Rule 2210 (b)(1)(D)(iii) and FINRA Rule 2210 (c)(7)(C).

© 2021 Siebert AdvisorNXT All rights reserved.