Stocks could not manage a broad, positive close yesterday as investors could not get the Fed fear out of their bones. Construction on new homes declined by nearly -15% in March and permits, a leading indicator, also dipped.

How do you get rid of inflation? Do you remember the last time one of your newfangled gadgets went on the fritz or froze up for no reason? You tried not to panic, you remembered those sage words from your mother, “be patient, think before you act.” You considered calling your kid or grandkid, but that nuclear option was only for worst case scenarios. Then it came to you. Simply unplug the damned thing and start fresh. I KNOW YOU HAVE DONE THIS. Don’t be ashamed because it probably did the trick.

Can I let you in on a little secret? Inflation is not a new problem. It has dogged not only the US but global economies for centuries. My far-distant descendent Marie Antoinette literally lost her head for suggesting cake to fix France’s nasty bout of inflation. I am pretty sure she never actually said “let them eat cake,” but I am pretty positive that she enjoyed a slice or two. In 1917, women took to the streets in Petrograd (now St. Petersberg), Russia demanding “bread and peace,” and that event is credited as the start of the Russian Revolution… we all know that it did not end well for Tsar Nicholas, his family, and the 5 to 10 million citizens who were killed either. There was the Weimar Republic Hyperinflation event after World War I that spurred the rise of the Nazi party and led to World War II, which turned out badly for the whole world. So, keeping inflation in check is kind of important.

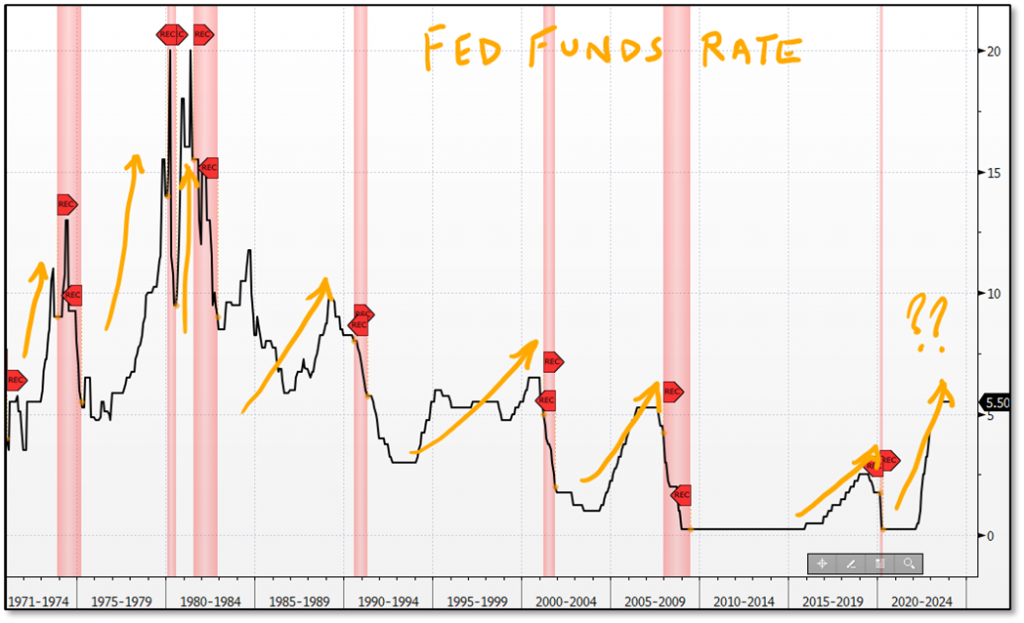

The US seems to have come up with a non-violent way of controlling inflation. Do you want to know the secret? Just look at this chart and keep reading for the explanation.

Do you notice something peculiar on this chart of the Fed Funds Rate going back to 1970? All those red-shaded areas are recessions, AND THEY WERE ALL PRECEEDED BY RATE HIKES. That’s right. The playbook states that the central bank should make monetary conditions so tight that the economy simply implodes on itself. The jump in unemployment and economic calamity ensures that consumers will literally start hiding what money they have left under their mattresses while companies will simply stop investing capital to ensure survival. With significantly reduced demand, inflation is sure to decline. You don’t believe me? Just look at the chart again.

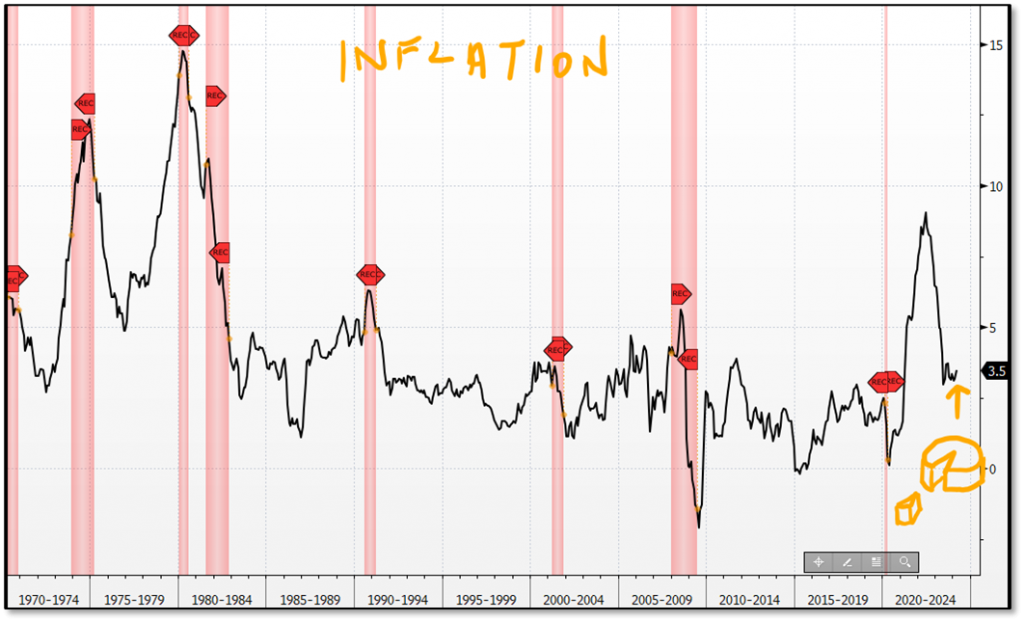

Now, to be clear, surely the Fed does not want to cause hardship or a recession intentionally. That said, it will likely do everything in its power to ensure a soft landing. Soft landing means no recession and normal inflation. “Normal inflation” is defined… BY THE FED as being +2.0%. The current level of interest rates is clearly restrictive, and inflation has indeed declined significantly from its intolerable 2022 levels. However, recent data has shown that inflation is sticky. The last reading was +3.5%, and the last holdouts of inflation have largely come from services, specifically housing costs.

Imagine if you are a landlord and you have borrowed lots of money in order to own your property. You rely on rents to make payments to your lenders. If those lending costs go higher because of higher interest rates, you have ABSOLUTELY NO INCENTIVE TO LOWER RENTS and essentially lose money. However, if the cost of financing simply gets too high and renters refuse to pay higher rents, building owners will simply go bankrupt. BUT new owners will be able to purchase the bankrupted properties at much lower prices, which will enable them to lower rents. How does that scenario sound? Yeah, I thought you would say that.

Well, my friends, the latest “words” from the Fed which were all variations of the term “data dependent,” imply that the Fed is either waiting for the economic data to show that inflation is back to its +2% target, or for data to show that the economy is on its way to a full-blown recession. That is right out of the tried-and-true Fed playbook. If you still don’t believe me, I will throw in a bonus chart which shows inflation over the same period as the above chart. Notice how the black lines peak inside the red-shaded areas and normalize right after. I don’t know about you, but I am thinking that cake might be a more pleasant solution.

WHAT’S HOT AND WHAT’S NOT IN THE PREMARKET

United Airlines Holdings Inc (UAL) shares are higher by +4.99% in the premarket after the company beat EPS and Revenues by +73.77% and +0.76% respectively. The company’s upbeat guidance included current and full-year beats as it has experienced better-than-expected demand. Potential average analyst target upside: +47.6.

JB Hunt Transport Services Inc (JBHT) shares are lower by -7.10% after the company missed EPS and Revenue estimates by a wide margin. The company attributed the miss to lower demand and freight price pressure. Performance in trucking and transport are viewed by many as a leading economic indicator. In the last month, 14 analysts have lowered their price targets while 1 has raised. Dividend yield: 0.93%. Potential average analyst target upside: +7.2%.

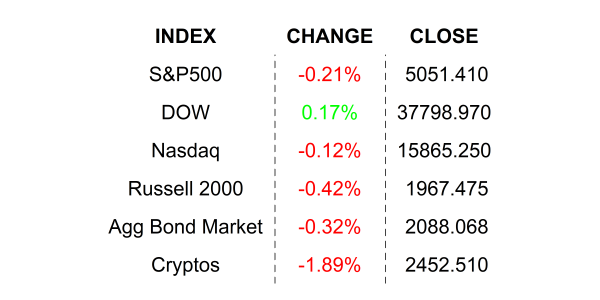

YESTERDAY’S MARKETS

NEXT UP

- Federal Reserve Beige Book will be released this afternoon. Analysts are expecting anecdotal reports from the various Fed regions to reflect continued positive economic conditions.

- Fed speakers today: Mester and Bowman

- Earnings after the closing bell: SL Green, Alcoa, Rexford, CSX Corp, Discover Financial, Equifax, Crown Castle, Kinder Morgan, and Las Vegas Sands.

IMPORTANT DISCLOSURES.

Muriel Siebert & Co., LLC is an affiliated broker/dealer of the public holding company, Siebert Financial Corporation, which also owns Siebert AdvisorNXT, LLC. Siebert AdvisorNXT, LLC is a registered investments advisor (RIA) with the SEC and with state securities regulators. We may only transact business or render personal investment advice in states where we are registered, filed notice or otherwise excluded or exempted from registration requirements. Investment Advisor products are NOT insured by the FDIC, SIPC any federal government agency or Siebert’s parent company or affiliates.

You are being provided this Market Note for general informational purposes only. It is not intended to predict or guarantee the future performance of any security, market sector or the markets generally. This Market Note does not describe our investment services, recommendations or market timing nor does it constitute an offer to sell or any solicitation to buy. All investors are advised to conduct their own independent research before making a purchase decision. This Market Note is to provide general investment education and you are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate for you based on certain investment objectives and financial situation. Do not use the information contained in this email as a basis for investment decisions. You should always consult your investment advisor and tax professional regarding your investment situation before investing. The charts and graphs are obtained from sources believed to be reliable however Siebert AdvisorNXT does not warrant or guarantee the accuracy of the information. Any retransmission, dissemination or other use of this email is prohibited. If you are not the intended recipient, delete the email from your system and contact the sender. This is a market commentary, not research under FINRA Rule 2210 (b)(1)(D)(iii) and FINRA Rule 2210 (c)(7)(C).

© 2021 Siebert AdvisorNXT All rights reserved.