Stocks got pounded on Friday as tensions in the Middle East threatened to boil over. According to University of Michigan, sentiment dropped in April, brought down by respondents’ view of current economic conditions.

I can read your mind. Trigger alert: I am going to briefly touch on world events… because, unfortunately, they influence stocks. The world is a nutty place where people just can’t seem to get along, for one reason or another. I haven’t told you anything you don’t already know yet. Well, this weekend, one of those disagreements led to an unprecedented drone and missile attack from Iran on Israel. I am sure that I don’t have to tell you that a great deal of crude oil comes from that region, so any regional conflict could certainly impact crude production. Still, nothing new to you, right? As of early, early this morning, things appear to be calm, but nobody is fool enough to believe that there will be no consequences for the aggressor. So, before you run to your computer and start buying defense and energy stocks, I want to have a talk to you about Eugene Fama. “WHO,” you ask?

Yes, Eugene Fama. If you hang around in financial circles long enough you will hear his name bandied about quite often. He is the winner of all sorts of prizes, chief amongst them is the Nobel Prize for his contribution to the Efficient Market Hypothesis (EMH). Fama first wrote about it in his Doctoral dissertation in the 1970s and it grew into one of Wall Street’s foundational principles. It is simple, but very important, so this morning I will refresh your memory about it, or perhaps, clue you in, if you’ve never heard of it.

The basic premise of the EMH is that stock prices factor in all information about their underlying companies. For example, if a company announces good earnings, that information is immediately reflected in its stock price, and immediately these days means…immediately, as in the speed of light. You are probably thinking, “really, that guy got a million-dollar prize and fancy medal for that bit of obviousness?” Come on, stay with me.

The EMH is typically categorized in three forms. The weak form states that a stock’s price or volume history does not contain any information about a stock’s future movement. In statistics, we have a fancy word for that: memoryless. I sometimes feel that way on Monday morning after a long weekend, but in the world of stocks, that is an important concept, because if you agree with it, you could just rip up all those fancy stock charts.

The semi-strong form asserts that a stock’s price instantly factors in all publicly available information. This is the famous one. In simple terms, it implies that you cannot achieve any excess returns trading on newly released information, because it is already factored into the stock’s price. Don’t rip up your Wall Street Journal just yet, and while you are at it, don’t throw away those stock charts either. Stay with me.

The strong form of the EMH states that even non-public information about a company is factored into a stock’s price. This is not as intuitive, because it implies that even insider information is already factored into a stock’s price. So, infamous insider trader Ivan Boesky paid a $100 million fine and spent 3 years in jail for nothing. IF you subscribe to the strong form of the EMH.

Let’s take a step back and simply appreciate the spirit of what the EMH articulates. A stock’s price reflects all available information about the company. Taken a step further, it implies that a stock’s price echoes the world’s collective thoughts, right or wrong, about what a company is worth. Back in the 1970s, most people had no clue about what was going on in the stock market until they opened their morning edition of the Journal, and those closing prices were from the day before. Today, you just have to look over the shoulder of the chap next to you on the subway to see not only a stock’s current prices, but even where all its options traded. Try not to bump into him, because he can buy or sell thousands of shares with his left thumb… on the 6 train! Stock trading is also no longer limited to 9:30 to 4:00 Wall Street Time. There is a premarket, a post market, there are index futures, and professional traders all over the world who trade in markets that influence stocks almost 24 hours a day. There are even super-fast computers that monitor the news and make trades in response to keywords… at the speed of light. So, indeed, it is feasible that a stock’s price does indeed, almost instantly, reflect all the information available.

Believe it or not, there is lots of debate on this topic, because it you believe it to the letter, you are virtually helpless in your investing. Indeed, professional managers, SOME OF THEM, are able to beat the market. Market anomalies do, in fact occur. And finally, crowd psychology is a big factor in the markets, though it is not always easy to understand. But, at a high level, stocks do, indeed reflect, very quickly, all released information about them.

You may wonder this morning why crude oil is down, or why stock futures are higher, given the weekend’s chilling news. That is because the scenario that unfolded over the weekend was already factored into prices. To be clear, that doesn’t mean that the crowd will not change its mind mid-session and send stocks in a completely different direction, but for now, rest assured that the market already knows about what happened over the weekend and probably, sadly, what might come next.

WHAT’S HAPPENING IN THE PREMARKET

Lockheed Martin Corp (LMT) shares are higher by +1.76% after JPMorgan Chase upgraded the company’s rating to OVERWEIGHT from NEUTRAL and raised its price target. Also, read about the Efficient Market Hypothesis above 👆🙃. The company is set to announce its results next week. Dividend yield: 2.80%. Potential average analyst target upside: +7.7%.

The Goldman Sachs Group Inc (GS) shares are trading higher by +3.76% after the company beat EPS and Revenue estimates by +31.47% and +9.49%, respectively. The results reflect a sharp increase in trading revenue. Dividend yield: 2.82%. Potential average analyst target upside: +11.1%.

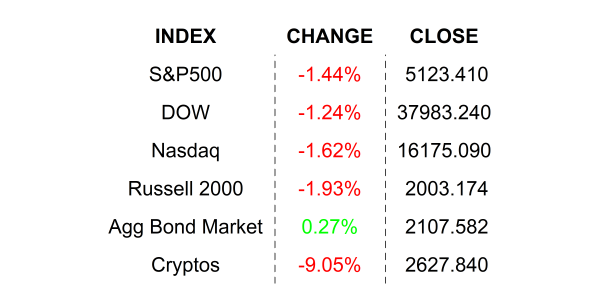

FRIDAY’S MARKETS

NEXT UP

- Retail Sales (March) may have increased by +0.4% after climbing by +0.6% in February.

- NAHB Housing Market Index (April) is expected to have remained at 51.

- Fed speakers today: Logan, Williams, and Daly.

- Later this week: lots of earnings, housing numbers, regional Fed reports, Fed Beige Book, and Leading Economic Index. Download the attached earnings and economic calendar for times and details.

IMPORTANT DISCLOSURES.

Muriel Siebert & Co., LLC is an affiliated broker/dealer of the public holding company, Siebert Financial Corporation, which also owns Siebert AdvisorNXT, LLC. Siebert AdvisorNXT, LLC is a registered investments advisor (RIA) with the SEC and with state securities regulators. We may only transact business or render personal investment advice in states where we are registered, filed notice or otherwise excluded or exempted from registration requirements. Investment Advisor products are NOT insured by the FDIC, SIPC any federal government agency or Siebert’s parent company or affiliates.

You are being provided this Market Note for general informational purposes only. It is not intended to predict or guarantee the future performance of any security, market sector or the markets generally. This Market Note does not describe our investment services, recommendations or market timing nor does it constitute an offer to sell or any solicitation to buy. All investors are advised to conduct their own independent research before making a purchase decision. This Market Note is to provide general investment education and you are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate for you based on certain investment objectives and financial situation. Do not use the information contained in this email as a basis for investment decisions. You should always consult your investment advisor and tax professional regarding your investment situation before investing. The charts and graphs are obtained from sources believed to be reliable however Siebert AdvisorNXT does not warrant or guarantee the accuracy of the information. Any retransmission, dissemination or other use of this email is prohibited. If you are not the intended recipient, delete the email from your system and contact the sender. This is a market commentary, not research under FINRA Rule 2210 (b)(1)(D)(iii) and FINRA Rule 2210 (c)(7)(C).

© 2021 Siebert AdvisorNXT All rights reserved.