Stocks pulled back yesterday, dragged down by technology shares as the EU takes aim at the winners. New Homes Sales slowed unexpectedly in February showing that the road to recovery is not a straight path.

Participation prize. Now that is a controversial social topic that I won’t get into, but I will apply it to the world of business and finance. Capitalism is all about providing opportunities for all to succeed with good ideas and gumption. You have a good idea, you scrape together a few dollars, you fight, you fight, fight, you gain ground, you innovate, you fight, you fight, you attract more capital, you carefully manage growth, you fight, you fight, you get more recognition, you manage growth successfully, and eventually you win. Your prize is financial success. But what about the companies who didn’t make it through the first fight-fight-fight stage because, perhaps, their idea wasn’t good enough, or they lacked the shrewdness it took, or maybe they made tactical errors along the way. Do those companies deserve to reap great financial gains as well?

Do you like your iPhone? Sure, you do, that is why you shelled out a ton of money to get it. Not an Apple fanboy? Ok, how about your Android phone. You like those cool features and how it seamlessly connects to your Google mail. How many times a day do you “google” something just because you want to know. Looking for the best pizza? Want to make sure that pain in your arm is not life threatening? You “google” that, don’t you. Do you like getting on Facebook and seeing that your high school friends’ kids look exactly like you remember your high school friends? Sure, you do. Do you like scrolling through Instagram and forwarding cute puppy pictures to your kids and getting inspired by some guy who cooks amazingly decadent, chef-quality dishes topped with caviar in his home kitchen? Sure, you do. Have you ever learned how to change a faucet or watched a 98-year-old Granny in Umbria make a pasta dish from scratch on YouTube? Yep ✅. Are you ever amazed that you can order a bottle of vitamins or a pair of socks from Amazon and have them show up on your porch in a box with a smiley face the very next day. Come on, you love that. How do you think that is all possible?

What if you don’t care about any of that stuff, but you do care about making money in your brokerage account. You do your homework. YOU READ THIS MARKET NOTE REGULARLY… ish. You consult your smart friends, kids, and grandkids. You are careful and you don’t allow yourself to get too emotional. You stick to the facts. You find some really good companies that continuously innovate and that have fantastic management. Their products and services are top-notch, affecting millions if not billions of people. They are profitable and they use those profits to make better products, and in some cases even return some of the excess to shareholders in stock buybacks and dividends. You like those companies, so you invest in them. Because you chose wisely and those companies delivered on those promises, you profited when those stocks ran up. How do you think that is possible?

Does it seem like this story needs some background, patriotic theme music or something? Hold on Mr. DJ don’t cue the music just yet. Imagine if some bureaucrat somewhere decided that it was not fair that those companies you picked were so successful. That bureaucrat decides to fine the successful companies or decides to limit access to customers. Why would something like that happen? To make the playing field easier for competition, so companies that couldn’t make the first cut, will now have a chance to win. That seems unconscionable, doesn’t it? Well, sorry to be the bearer of bad news, but the EU is doing that to Apple, Alphabet, and Meta right now. Apple is also being sued by the Department of Justice arguing that Apple monopolizes the smartphone market. REALLY? If the reward for hard work, smart decisions, and good ideas is to have your prize taken away, why bother getting into the race. Let’s remember what the driver of innovation and all the good things in our lives has been. Was it regulation? No, it was innovation, and good old capitalism. Is capitalism perfect? Not always, but imagine where we would all be without it. Keep fighting innovators, we got you!

WHAT’S UP OR down IN THE PREMARKET

McCormick & Co Inc (MKC) shares are higher by +4.02% in the premarket after it beat EPS and Revenue estimates by +9.72% and +3.51% respectively. The company maintained its full-year guidance as higher prices paved the way for the company’s solid sales growth. The companies 24.72x forward PE is richer than the 17.46x PE of its comp group. Dividend yield: 2.4%. Potential average analyst target upside: +1.1%.

Viking Therapeutics Inc (VKTX) shares are higher by +17.5% in the premarket. This small cap, pre-revenue company reported success in its phase 1 trials of an oral obesity drug. In the last month, 9 analysts have raised their price targets while none has lowered them. Investors in the company’s IPO in 2015 would have made roughly +836% return on their investment. Potential average analyst target upside: +54.1%.

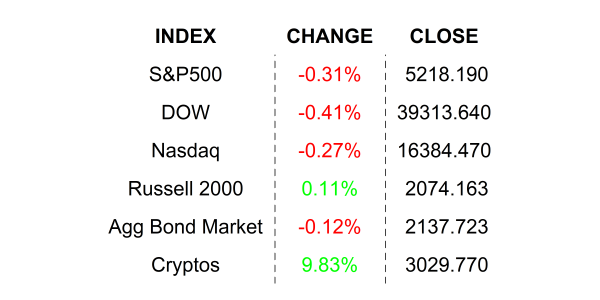

YESTERDAY’S MARKET

NEXT UP

- Durable Goods Orders (Feb) is expected to show a +1.0% rise after a -6.3% decline in January.

- FHFA House price Index (Jan) is expected to have climbed by +0.3% after rising by +0.1% in the prior period.

- Conference Board Consumer Confidence (March) may have risen slightly to 107.0 from 106.7.

IMPORTANT DISCLOSURES.

Muriel Siebert & Co., LLC is an affiliated broker/dealer of the public holding company, Siebert Financial Corporation, which also owns Siebert AdvisorNXT, LLC. Siebert AdvisorNXT, LLC is a registered investments advisor (RIA) with the SEC and with state securities regulators. We may only transact business or render personal investment advice in states where we are registered, filed notice or otherwise excluded or exempted from registration requirements. Investment Advisor products are NOT insured by the FDIC, SIPC any federal government agency or Siebert’s parent company or affiliates.

You are being provided this Market Note for general informational purposes only. It is not intended to predict or guarantee the future performance of any security, market sector or the markets generally. This Market Note does not describe our investment services, recommendations or market timing nor does it constitute an offer to sell or any solicitation to buy. All investors are advised to conduct their own independent research before making a purchase decision. This Market Note is to provide general investment education and you are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate for you based on certain investment objectives and financial situation. Do not use the information contained in this email as a basis for investment decisions. You should always consult your investment advisor and tax professional regarding your investment situation before investing. The charts and graphs are obtained from sources believed to be reliable however Siebert AdvisorNXT does not warrant or guarantee the accuracy of the information. Any retransmission, dissemination or other use of this email is prohibited. If you are not the intended recipient, delete the email from your system and contact the sender. This is a market commentary, not research under FINRA Rule 2210 (b)(1)(D)(iii) and FINRA Rule 2210 (c)(7)(C).

© 2021 Siebert AdvisorNXT All rights reserved.