Stocks had a rocky session yesterday after a series of sobering earnings reports. Flash Purchasing Managers Indexes gave evidence of a contracting economy in products and services but came in slightly better than expected.

Let the sunshine in. Have you noticed the preponderance of solar panels on roofs lately? Sure, you have. I remember in the 1970s when solar energy was heralded as the world’s savior. Of course, we were in the middle of an energy crisis and folks were trying to figure out all sorts of creative ways to liberate themselves from the gas pump and that big, usually red-some-reason heating oil delivery truck. The once-darling nuclear energy option was spending an enormous amount of energy trying to overcome the stereotypes of glow-in-the-dark, two-headed bunny rabbits after a series of embarrassing failures. Solar, therefore, seemed like it could be just the answer to all our woes. I, being a nerd, was eager to get my hands on a solar cell… for scientific purposes, of course. Side note: for those readers that know me or knew me personally at the time, know that I am not embellishing. So, I enlisted the help of my scientist father who was usually quite skillful in acquiring hard-to-get, science-oriented materials for me. There was one problem… and it was a big one. COST ($$$$)!

We managed to track down a random startup located somewhere in the southwest US, which just happened to be nearby a national research lab. What we found was a small ½-inch square piece of silicon with two wires soldered to the back… for $750! Ok, my father was all about supporting my scientific pursuits, but this was far beyond reason. I had to pivot… I did… more on that toward the end.

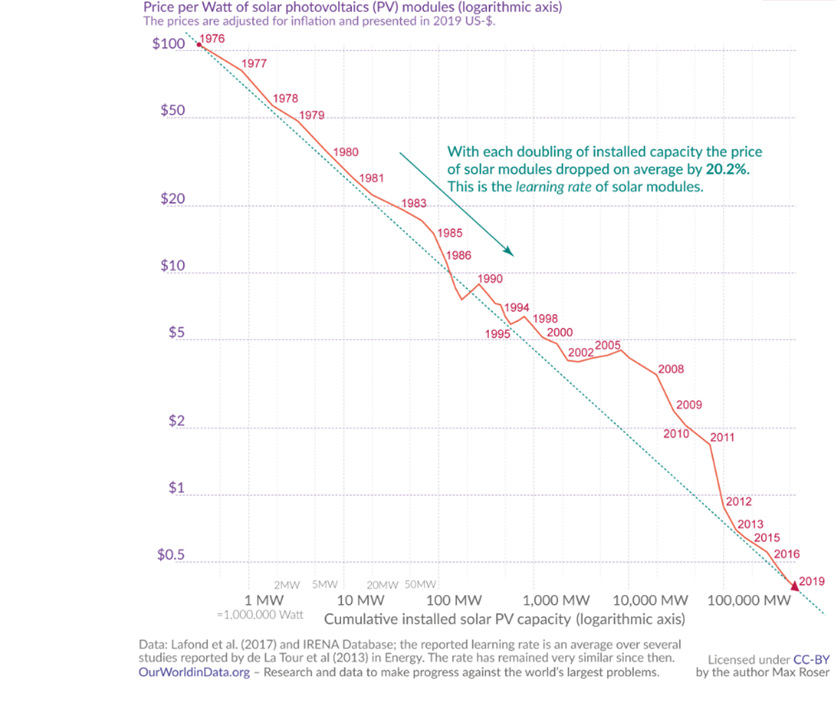

As you can probably guess by the graph above, the cost of solar energy has come down significantly since my early-nerd days, so much so that residential solar energy has gone from a cottage industry to… well, mainstream. In case you didn’t know, even though the cost of the materials has gone down, and the yields (amount of electricity produced per size of cell) have gone up, switching to solar is still a costly project. So how is it then that so many homes have switched, and I am not just talking about wealthy suburbs? Well, government subsidies have certainly helped a bit. Still don’t know? The answer is creative financing. Someone somewhere is willing to provide a loan which should cover the project and allow a homeowner to begin to reap big savings… once the loan is paid off, of course.

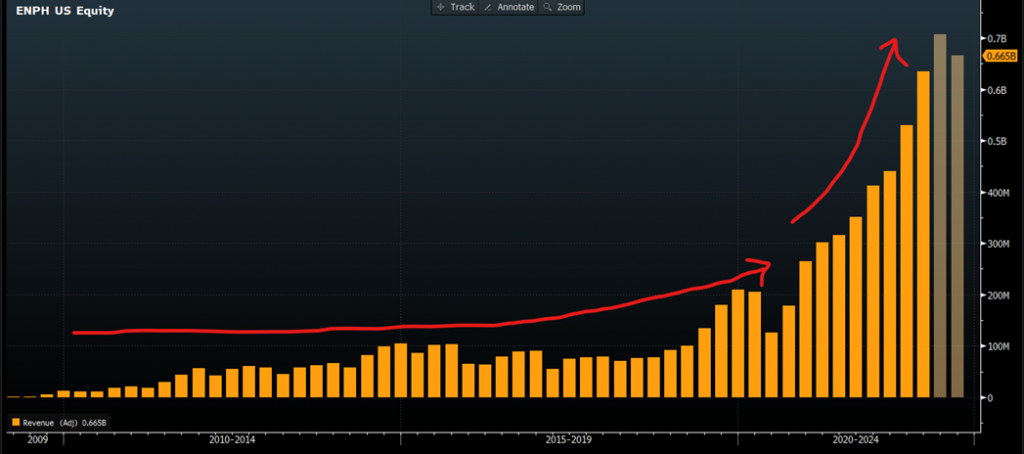

There are many publicly traded companies who are in the business of providing solar energy products and services. One of the most broadly held solar stocks is Enphase Energy (ENPH). Enphase was founded in 2006 and produces, amongst other things, microconverters, necessary for residential solar installations. The company’s strong management and superior product line have helped it become a leader in a fast-growing industry. The company went public in 2012 and had 2 secondary offerings in 2012 and 2016. As you will see by the following price chart, the stock price was relatively flat for many years until 2019 when the stock took off. The reason for the growth was attributed to… well, growth of revenues, which can be seen on the second chart. Check them out and keep reading, for the conclusion.

Enphase, as you can see by these charts, is the very definition of a growth company. Rapidly growing sales and a rapidly growing stock price reflecting it. The company’s stocks, like all great growth stocks struggled last year as interest rates climbed. Remember, higher bond yields make the value of future earnings worth less in today’s dollars… it’s a finance thing, but the primary reason why growth stocks struggled last year. Now that it appears that the Fed may be nearing the end of its aggressive hiking campaign, growth stocks have gotten a bit of relief and have recently gained back some ground. Just this morning, WHILE YOU SLEPT, I noticed that Enphase shares were down by -3.82% in the premarket. The reason for the decline is a Piper Sandler downgrade to NEUTRAL from OVERWEIGHT. The analyst also cut the company’s 12-month price target to $255 from $350. Why? Because demand for solar products is down… due to the increase in financing costs DRIVEN BY HIGHER INTEREST RATES. This is just another example of how tight monetary policy can and DOES affect economic growth. For the record, 65% of analysts rate it a BUY while only 3.1% of them rate it a SELL. The potential average analyst target upside for the stock is +41.6%. Also, for the record, because $750 was a lot of money back then (as it is now), I had to get creative and build my own solar panel. That, incidentally, won me a 4th place ribbon in a state-wide science fair. True story.

YESTERDAY’S MARKETS

Stocks bounced around quite a bit yesterday in the wake of some dicey earnings, ultimately closing mixed. The S&P500 slipped by -0.07%, the Dow Jones Industrial Average gained +0.31%, the Nasdaq Composite Index traded lower by -0.27%, and the Russell 2000 Index declined by -0.27%. Bonds gained and 10-year Treasury Note yields slipped by -5 basis points to 3.45%. Cryptos slipped by -0.41% and Bitcoin traded lower by -0.41%.

NEXT UP

- MBA Mortgage Applications (Jan 20) were up by +7% for the week, lower than last week’s +27.9% gain. For the record, average 30-year fixed mortgage rates are around 6.43%, lower than last year’s highs around 7.25%.

- This morning, Abbot Labs, General Dynamics, and Hess Corp all beat on EPS and Sales. US Bancorp, Stiffel, and Boeing came up short on both fronts, while Elevance, AT&T, Kimberly Clark, and NextEra Energy had mixed results.

- After the bell earnings: IBM, Levi Strauss, Seagate, United Rentals, Crown Castle, ServiceNow, Lam Research, Tesla, Steel Dynamics, CSX, SL Green, Raymond James, and Las Vegas Sands.

IMPORTANT DISCLOSURES.

Muriel Siebert & Co., LLC is an affiliated broker/dealer of the public holding company, Siebert Financial Corporation, which also owns Siebert AdvisorNXT, LLC. Siebert AdvisorNXT, LLC is a registered investments advisor (RIA) with the SEC and with state securities regulators. We may only transact business or render personal investment advice in states where we are registered, filed notice or otherwise excluded or exempted from registration requirements. Investment Advisor products are NOT insured by the FDIC, SIPC any federal government agency or Siebert’s parent company or affiliates.

You are being provided this Market Note for general informational purposes only. It is not intended to predict or guarantee the future performance of any security, market sector or the markets generally. This Market Note does not describe our investment services, recommendations or market timing nor does it constitute an offer to sell or any solicitation to buy. All investors are advised to conduct their own independent research before making a purchase decision. This Market Note is to provide general investment education and you are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate for you based on certain investment objectives and financial situation. Do not use the information contained in this email as a basis for investment decisions. You should always consult your investment advisor and tax professional regarding your investment situation before investing. The charts and graphs are obtained from sources believed to be reliable however Siebert AdvisorNXT does not warrant or guarantee the accuracy of the information. Any retransmission, dissemination or other use of this email is prohibited. If you are not the intended recipient, delete the email from your system and contact the sender. This is a market commentary, not research under FINRA Rule 2210 (b)(1)(D)(iii) and FINRA Rule 2210 (c)(7)(C).

© 2021 Siebert AdvisorNXT All rights reserved.