Stocks rallied yesterday on a stronger than expected GDP figure which suggested that a “soft landing” is possible. It is still unclear if the inflation outlook will cooperate with that narrative.

Goldilocks. We have been taught that everything has a cost associated with it. You can’t have pleasure without some pain. “No pain, no gain,” so goes the saying. There are hundreds more, but you get the point. Those adages are particularly poignant on Wall Street, whose very backbone is built on the concept of greater risk is required for greater reward. The concept can also be found in the Fed’s sacredly held Phillips Curve. “The what-curve,” you are thinking, “come on Marko, it’s Friday.” Don’t worry, I will get you through it.

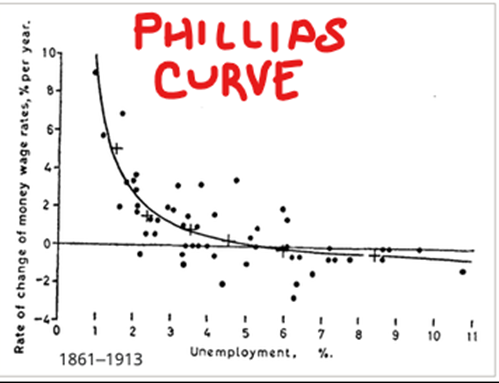

William Phillips, an economist wrote a paper in 1958 entitled The Relationship between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861-1957. I know you are not going to place that on the top of your reading list this weekend, so I will make it simple. In the paper, Phillips laid the groundwork for the theory that the inflation rate and the unemployment rate are correlated. How interesting that those two things are the Fed’s dual mandate. Ah, no wonder the Fed holds the concept in such high regard. Check out this rough drawing from the original paper, then keep reading.

Fancy graphics, eh? I’ll bet that Phillips even used a ruler to create it 😊. Anyway, the important takeaway is that low unemployment leads to high inflation. That concept was picked up by mainstream US economists and ultimately adopted by the Federal Reserve in the 1970s where it still serves as a foundation. It is of no concern to you and me unless we have high inflation and a hawkish Fed… which we have. Now, making matters worse is the fact that we have a low unemployment rate, right near the lows not experienced since 1969. That puts us on the lower left-hand portion of the above chart, you know, the low-unemployment high inflation section.

Now, this chart is overly simplified, but the Fed very much subscribes to the theme. That is also precisely why the Fed is watching the labor market so closely. If we are confined to the two axes on the chart, we can only get inflation lower by raising the unemployment rate. How can the Fed cause that to happen? Why, they can raise interest rates and cause the economy to slow down to the point where companies, under pressure to maintain profitability, lay off workers. THEN, and only then, at least according to the simple world in the chart, can inflation recede. I think that we all get this concept by now as it has been drilled into us over these past 18 months or so. The big question that remains is how far can the Fed attenuate economic growth before the economy collapses? Sure, unemployment will get higher, and inflation will get lower, but no one wants an economic crisis. What we, including the Fed, would all prefer, would be slightly elevated unemployment rates, lower prices, and an economy that might be slower, but not contracting. That is the equivalent to porridge that is just right. The contemporary term for that is “soft landing.”

Yesterday’s slightly better than expected GDP showed that the US economy remains resilient contemporaneous with slowing inflation. The unemployment rate still remains low, and while we won’t get another read of that until next Friday, we have heard a lot of companies planning layoffs. Just this morning, we learned that WHILE YOU SLEPT, Hasbro, of Mr. Potato Head and Monopoly fame, is cutting 15% of its workforce while announcing that it had weak holiday sales. At some point soon, we will move right along the x-axis of the Phillips curve, and inflation on the y-axis, will move down. It’s a tradeoff… like everything else in life.

WHAT’S SHAKIN’

Intel Corp (INTC) shares are lower by -10.4% in the premarket after it announced that it missed EPS and Sales estimates by -48.56% and -3.10% respectively. Talk about margin compression. The company also furnished weak forward guidance. Dividend yield: 4.85%. Potential average analyst target upside: -0.9%. WHY IS THIS NEGATIVE? Because the company’s stock price is above the average analyst 12-month price target. While this may be interpreted as the stock being too expensive, it does not mean that it cannot go higher.

Hasbro Inc (HAS) shares are lower by -5.77% in the premarket after the company announced that it had weaker than expected holiday sales and will, as a result lay off 1000 workers, 15% of its workforce. The company is expected to announce its earnings on Feb 16th. Dividend yield: 4.39%. Potential average analyst target upside: +21.3%.

Visa Inc (V) shares are higher by +1.02% in the premarket after it announced that it beat EPS and Revenue estimates by +8.78% and +2.76% respectively. In the past month, 48% of analysts changed their price targets 19 up, 0 down, 19 unchanged, and 1 dropped. Dividend yield: 0.80%. Potential average analyst target upside: +15.7%.

YESTERDAY’S MARKETS

Stocks climbed yesterday after a better-than-expected GDP number fueled hopes of a soft landing. The S&P500 gained +1.10%, the Dow Jones Industrial Average climbed by +0.61%, the Nasdaq Composite Index advanced by +1.76%, and the Russell 2000 Index traded higher by +0.67%. Bonds fell and 10-year Treasury Note yields gained +5 basis points to 3.49%. Cryptos added +2.07% and Bitcoin slipped by -2.19%.

NEXT UP

- Personal Income (Dec) is expected to have grown by +0.2% after climbing +0.4% in November.

- Personal Spending (Dec) is expected to have declined by -0.1% after gaining +0.1% in the prior month.

- PCE Deflator (Dec) may have eased to +5.0% from +5.5%.

- Pending Home Sales (Dec) is expected to have slipped by -1.0% after falling by -4.0% in November.

- University of Michigan Sentiment (January) is expected to come in at 64.6 in line with preliminary estimates.

- Next week: Lots more earnings and a jampacked economic calendar which includes Consumer Confidence, ISM Manufacturing, Factory Orders, monthly employment numbers, and the FOMC Meeting. It will be a busy week, so check back on Monday for calendars and details.

IMPORTANT DISCLOSURES.

Muriel Siebert & Co., LLC is an affiliated broker/dealer of the public holding company, Siebert Financial Corporation, which also owns Siebert AdvisorNXT, LLC. Siebert AdvisorNXT, LLC is a registered investments advisor (RIA) with the SEC and with state securities regulators. We may only transact business or render personal investment advice in states where we are registered, filed notice or otherwise excluded or exempted from registration requirements. Investment Advisor products are NOT insured by the FDIC, SIPC any federal government agency or Siebert’s parent company or affiliates.

You are being provided this Market Note for general informational purposes only. It is not intended to predict or guarantee the future performance of any security, market sector or the markets generally. This Market Note does not describe our investment services, recommendations or market timing nor does it constitute an offer to sell or any solicitation to buy. All investors are advised to conduct their own independent research before making a purchase decision. This Market Note is to provide general investment education and you are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate for you based on certain investment objectives and financial situation. Do not use the information contained in this email as a basis for investment decisions. You should always consult your investment advisor and tax professional regarding your investment situation before investing. The charts and graphs are obtained from sources believed to be reliable however Siebert AdvisorNXT does not warrant or guarantee the accuracy of the information. Any retransmission, dissemination or other use of this email is prohibited. If you are not the intended recipient, delete the email from your system and contact the sender. This is a market commentary, not research under FINRA Rule 2210 (b)(1)(D)(iii) and FINRA Rule 2210 (c)(7)(C).

© 2021 Siebert AdvisorNXT All rights reserved.