Stocks gained on Friday despite more hawk talk from Fed officials. Home sales continue to slump and are now at 2012 levels – the Fed’s work is being felt.

Look both ways. Ok, so we managed to speed our way through most of the Fall and now find ourselves at Thanksgiving week. This is an interesting time for markets. It has nothing to do with binge eating turkey and pie, but rather more to do with investor introspection. I use the word “introspection” carefully; I don’t want to infer that there is some deep soul searching, religious epiphany that impacts markets. No, it is simply the timing of the holiday where many view it as the beginning of the end of the year when professional and armchair traders alike look back on the year to date and decide what they are going to do to dress up their portfolios for year end. So yeah, it is a mental thing but not really a spiritual thing. It is also a time when trading volumes become more volatile, which can make market movements more erratic. I am sure that I don’t have to tell you that this has been a tough year for investors. The S&P500 is down by nearly -17% year to date and some of our favorite stocks from the past have logged drops that we would have never thought possible. That just makes the introspection process a bit deeper, which can translate into… well, increased volatility.

Last week was a good summation of what will be on investors’ minds in the days and weeks ahead. Earnings season is coming to a close and the theme of layoffs, lowered guidance, and cost-cutting measures dominated. This, of course, can be viewed as bad and good. Good, if you believe that low unemployment causes inflation (the Fed does), and bad if you are concerned about a weaker economy. Last week’s housing numbers all pointed to painful decline in sales, prices, and new development. Regional Fed reports pointed to headwinds with lower-than-expected outcomes, and the Leading Index, a time-honored leading recession indicator, slipped further than expected. On a brighter note, the Producer Price Index came in lower than expected, adding to the prior week’s cooler-than-expected Consumer Price Index in some early signs that inflation may be loosening its grip. One thing not loosening its grip is the Fed… or at least they are not talking about it in public. The week’s Fed chatter can only be classified as hawkish to the max. The bankers were zealous in their insistence that rate-hiking is far from over. So, where did that leave markets?

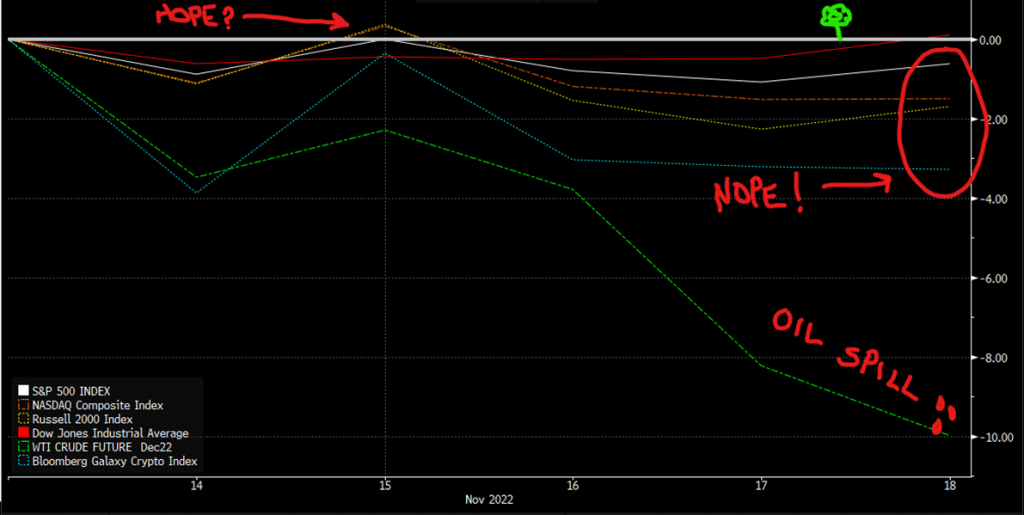

The Dow ended slightly in the green while the S&P, Nasdaq, and the small-cap index ended the week in the red. But, as you will note from the chart below, it was not a straight path. There were plenty of ups and downs as investors reacted to hawkish Fed officials, weaker-than expected earnings, nascent bullish feelings, and dashed hopes of a pivot. Yields on 10-year Treasury notes were as high as 3.85% and as low as 3.68% before closing the week out at 3.82%. If we add in cryptos, still trying to make sense of the FTX fallout, and crude oil which has been dominated by a potential slowdown in China, the chart becomes even more dramatic, because we note the volatility of cryptos and the big decline in crude oil.

So, that just about sums it up. Lots of hopes risen and dashed, green shoots from inflation, and fear of the Fed looms large over the markets, all leading to lots of volatility. These themes, along with the markets’ reactions are likely to continue through the remainder of the year. Don’t lose hope however, there are still a few more important economic releases in the weeks ahead which can change the expected path of interest rates… and everything else in response. Of course, we have the final Fed meeting of the year in a few weeks. This week ahead will find minds and hearts on family time, turkey, and high-stakes sports (football, both American and non-American)… and of course Fed minutes which may give us some more insight into the emerging battle between the Hawks and Doves. It is not likely to be a straight line in any direction.

FRIDAY’S MARKETS

Stocks gained on Friday despite more cautious Fed speak and options expiration. The S&P500 rose by +0.48%, the Dow Jones Industrial Average gained +0.48%, the Nasdaq Composite Index inched higher by +0.01%, and the Russell 2000 Index advanced by +0.58%. Bonds pulled back and 10-year Treasury Note yields added +6 basis points to 3.82%. Cryptos slipped and Bitcoin lost -0.26%.

NEXT UP

- Chicago Fed National Activity Index (Oct) is expected to come in at 0.00 after last month’s 0.10 reading.

- San Francisco Fed President Mary Daly will speak today.

- The week ahead: still more earnings announcements along with flash PMIs, more housing numbers, Durable Goods Orders, University of Michigan Sentiment, and FOMC minutes. Please refer to the attached earnings and economic calendars for times and details.

IMPORTANT DISCLOSURES.

Muriel Siebert & Co., LLC is an affiliated broker/dealer of the public holding company, Siebert Financial Corporation, which also owns Siebert AdvisorNXT, LLC. Siebert AdvisorNXT, LLC is a registered investments advisor (RIA) with the SEC and with state securities regulators. We may only transact business or render personal investment advice in states where we are registered, filed notice or otherwise excluded or exempted from registration requirements. Investment Advisor products are NOT insured by the FDIC, SIPC any federal government agency or Siebert’s parent company or affiliates.

You are being provided this Market Note for general informational purposes only. It is not intended to predict or guarantee the future performance of any security, market sector or the markets generally. This Market Note does not describe our investment services, recommendations or market timing nor does it constitute an offer to sell or any solicitation to buy. All investors are advised to conduct their own independent research before making a purchase decision. This Market Note is to provide general investment education and you are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate for you based on certain investment objectives and financial situation. Do not use the information contained in this email as a basis for investment decisions. You should always consult your investment advisor and tax professional regarding your investment situation before investing. The charts and graphs are obtained from sources believed to be reliable however Siebert AdvisorNXT does not warrant or guarantee the accuracy of the information. Any retransmission, dissemination or other use of this email is prohibited. If you are not the intended recipient, delete the email from your system and contact the sender. This is a market commentary, not research under FINRA Rule 2210 (b)(1)(D)(iii) and FINRA Rule 2210 (c)(7)(C).

© 2021 Siebert AdvisorNXT All rights reserved.