Do you remember the last economic recession? Well, if you watch the news and you have an investment portfolio, you probably remember that we had a brief recession at the beginning of the pandemic in 2020. You also most likely recall that there was The Great Recession somewhere around 2008. I used the word “somewhere” because if you were employed, you probably don’t even recall exactly when the US was in a recession. If you are of a certain age, you probably recall those video clips of all the Lehman Brothers executives carrying boxes of softball trophies, pictures, framed sports memorabilia, and other personal items that once littered their opulent offices out the front door of the once-dominant investment bank just after the company collapsed. Come on, now you remember. You are thinking “those were tough times,” and you are likely to remember that your investment portfolio took a big hit sometime in fall, 2008 through sometime in the winter of the following year. In reality, do you know when the recession actually began, how long it lasted, and what even defines a recession?

Let’s fast forward to today. If you watch a financial news network, you have surely seen the rise in segments on recession. Even if you like to take in your news from a local affiliate of one of the big US broadcasters, you are likely to have picked up a mention or two of the potential impending recession. Even if you avoid the news altogether (and I don’t blame you if you do), you have probably felt that things are a bit different with the economy – specifically, you are sure to have felt the inflation hitting your budget and wondered how high prices will go before something breaks. I am also quite sure that you have seen the decline in your investment portfolio starting late last year. The Bureau of Economic Statistics just released its first estimate second quarter GDP growth and showed that US Gross Domestic Product declined for the quarter. What’s more, Q2 was the 2nd consecutive negative growth quarter, putting the US, by some measures, in a technical recession. This would, therefore, be a good time to understand exactly what a recession is, what it means to you personally, and what impact it may have on your investments.

What is a recession, really?

Before we can get into all the technical details, let’s get into the forces that cause a recession. Let’s start with the basic definition. A recession is significant, protracted, and broad pullback in economic activity.

Economic activity

The most basic and widely accepted measure of economic activity is the Gross Domestic Product, or GDP, as you probably know it. GDP is simply a measure of all the goods and services produced, bought, or sold,

depending on how you look at things, though it doesn’t really matter. Classical economics breaks GDP down into several inputs.

- • Consumption Spending (C)

- • Private Investment (I)

- • Government Spending (G)

- • Net Exports (NX)

Together these four aggregates make up GDP in the following basic formula:

Gross Domestic Product = C + I + G + NX

Yes, it is that simple, and we will get back to it in a little bit. Since the Industrial Revolution, we have been quite keen on growing economic output. Growth is good and decline is bad. Unless you are a golfer measuring your handicap, this mantra should be a well-understood one, and it has stuck. Growth is good, and bigger is better.

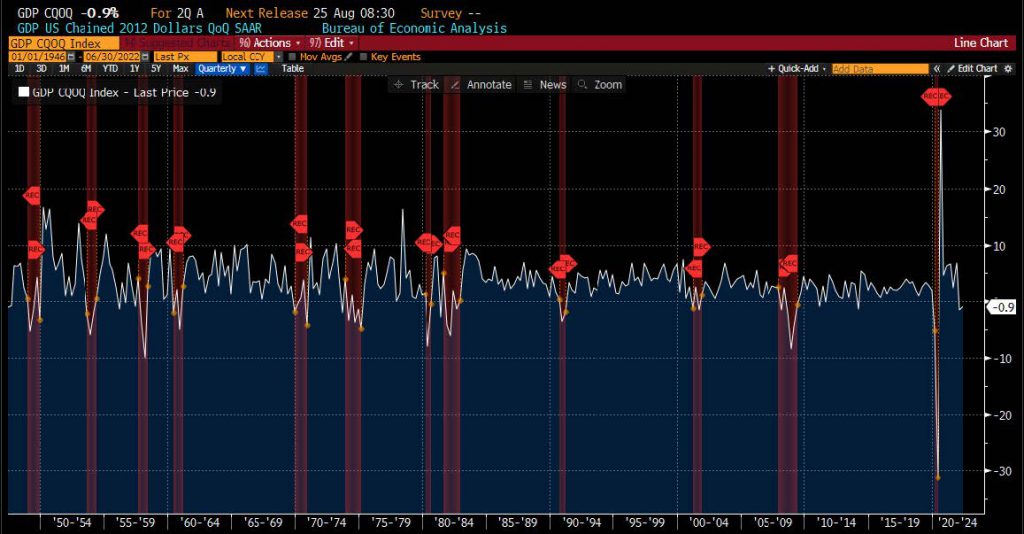

Over time, economies grow and shrink. That is referred to as a business cycle. Economies expand, they peak, they pull back, they trough, they expand once again, and so on. To avoid getting into too much theory we must accept that the expansions and contractions are natural, and that they cannot be avoided completely, though the bumps can be minimized to policy. This can be seen in the following illustration of GDP growth over time. Areas shaded in red are recessions and the white solid line is GDP growth.

Going back to our simple definition of recession above, we are interested in knowing when those downturns occur, so naturally we follow those GDP components carefully, attempting to predict, as early as possible, any material changes in direction. For example, if consumers, which are folks like you and I, stop spending money, consumption (C) will shrink and that will have material impact on overall GDP growth. In fact, consumption (C) makes up roughly 2/3 GDP, making our purchase habits critical to growth. While we are on the numbers, private investment (I), makes up another roughly 17%, and government expenditure makes up most of the balance. Net exports have minor impact in most cases, but it’s important to remember that money leaving the country through imports is a drag on the economy while money coming into the economy through exports is additive to the economy. Of course, at the end of the day we want consumers to constantly spend more money, businesses to invest more and more, the Government to spend an always growing amount of money, exports to grow, and imports to decline. That is all it takes to keep the GDP, the economy, expanding. Easy, right? That was a joke, of course, it is very complicated to keep all those factors working in the right direction for sustained periods of time.

If we simply focus on C and I, we can understand why economies grow and shrink. Consumers will pull back on their purchases if they grow uncomfortable about their future financial health, deferring non-essential purchases until the fear subsides. Consumers may also defer purchases when inflation is high, hoping to buy in the future, when prices are lower. Private investment (I) represents principally, business-based capital expenditures. Examples would be developing new buildings (for residential and non-residential), upgrading existing buildings, new equipment (machinery or even computers/IT spending). A company would pull back on investment if management was uncertain about financial conditions in the near future. Additionally, companies may decide to put off capital-intensive projects if the cost of borrowing goes up, as those projects are typically financed through various types of debt. That occurs when interest rates are on the rise. So, as you can see, with my most basic examples, if financial conditions are just right, consumers will grow their spending and businesses will continue to increase their investment activities. In certain financial conditions, such as exist today in which the US is experiencing high inflation, low consumer confidence, and rising interest rates, economists are correct to be concerned that GDP can experience a decline. And has done just that…for 2 quarters in a row. Now we know what causes a decline in GDP, and we are experiencing it. So, are we in a recession, or not?

Recession defined, refined

Now that we know how and why GDP pulls back, we must satisfy the protracted adjective in our simple definition of recession, above. In other words, how long is long enough for us to go from minor economic hiccup to recession? Well, the most commonly accepted qualifier is at least 2 quarters. Specifically, 2 consecutive quarters. So, the rule of thumb for a recession is 2 consecutive quarters of shrinking GDP. Based on yesterday’s GDP number, using the aforementioned definition, the US is in a recession. Is 2 quarters long enough to be considered protracted? Well, going back to 1900 the average length of a recession was around 15 months, a little over 4 quarters. But since 1980, the average length of the 6 recessions (including the COVID-19 recession) was around 9 months, or 3 quarters. Without the last recession, that average goes to around 11 months, between 3 and 4 quarters. Therefore 2 quarters may be enough to sound the alarm to raise the yellow flag, but perhaps not enough to raise the red flag. We can therefore comfortably say the protracted requirement is partially covered by the 2 quarters. The third and final requirement is significant. So how significant, or intense is the economic pullback? Since The

Great Depression, we have experienced 15 recessions and the average GDP pullback from peak to trough is -6.79%. Currently, GDP has pulled back by a total of -2.5%. Therefore, I think that the significant requirement is only partially satisfied, like the protracted one. So, I ask once again, are we in a recession or not? Wouldn’t it be nice if there was someone or some entity that could be tasked with making that call?

National Bureau of Economic Research (NBER)

NBER is a private, non-profit entity dedicated to economic research. NBER’s economists collect data and attempt to produce research that would benefit policymakers in their efforts. One of the organization’s key focuses is determining business cycles. Remember that from earlier? NBER collects data and its collection of economists determine if the economy is at a peak or in a trough. If we know that with confidence we can effectively, quantitatively determine if the US is actually in a recession. The NBER is a non-partisan organization that is unaffiliated with the Government, many government agencies rely on it to make the final call on recessions. Additionally, many Wall Streeters rely on the NBER pronouncements as well. There is just one problem. NBER takes many months to determine whether the US is in a recession and in some cases, we may already be in an expansion when the distinction of recession is given. NBER attempts to satisfy our simple definition of recession quantitatively by using indicators such as GDP (which is obvious), but a host of others include Industrial Production, Retail Sales, and employment figures. Many of these numbers are lagging, meaning that they are released at least a month after, and in some cases almost a quarter after the fact, which while it adds to the accuracy of the classification, it takes away the timeliness of proclamation. Once all the data is collected a committee of economists will further examine the data and ultimately make the final decision. Accurate, long-standing, but not so timely or, for that matter, useful to you and me…at the moment.

So, where are we… at the moment?

Just by looking at the examples above, we know that GDP has receded for 2 consecutive quarters. That is long, but not too long yet. The GDP rout is noteworthy, but not sizable enough to meet the standard set by the historical mean. Retail Sales has maintained respectable growth to date. Looking back through the first 2 quarters, you know, the ones that had negative GDP growth, we witnessed the following change in Retail Sales: +2.7%, +1.7%, +1.2%, +0.7%, -0.1%, +1.0% from January through June, respectively. During the 2008/2009 recession Retail Sales were sharply lower. Similarly, Industrial Production, continues to remain respectable with prints of +0.38%, +0.83%, +0.71%, +0.77%, +0.05%, and -0.2% through the pullback quarters ending in June. Looking back to earlier recessions, the numbers were dramatically lower. In fact, there have been periods of extended pullbacks outside of recessions.

Though this is hardly an exhaustive list of indicators that economists use to label an economic pullback a recession, I am sure by now, you are following the logic. There is just one more thing. Going back to my first assertion, do you feel any different today than a week before the GDP release? If we were in a recession, wouldn’t you expect to feel something? That is where unemployment enters the picture. Though it is not a part of the traditional definition, high unemployment not only causes a pullback in consumption (remember that from our equation), but it also causes a decay in consumer confidence…

which also causes consumers to spend less. The employment situation in the US to date has been quite strong with the rate of unemployment just above the decades long lows achieved just prior to the pandemic. Conversely, job openings (JOLTS Job Openings) remain around all time highs. It is true that there is a growing list of companies who publicly announced hiring freezes in an abundance of caution, but those policy changes have yet to impact the numbers. What I am saying here, is that a recession, feels like a recession when unemployment is high. There will be a host of economic numbers in the coming weeks that will possibly fill in some of these wide gaps in our definition of recession. So, are we in a recession? Technically, most likely, but not a deep one…yet. Will NBER call this a recession several months from now? Given what we know today, it is not clear? Do you feel like we are in a recession? If your answer is “no” then remember that recession is just a word. Stay productive, keep working hard, be patient with inflation, and most importantly, keep on consuming…wisely.

IMPORTANT DISCLOSURES.

Muriel Siebert & Co., LLC is an affiliated broker/dealer of the public holding company, Siebert Financial Corporation, which also owns Siebert AdvisorNXT, LLC. Siebert AdvisorNXT, LLC is a registered investments advisor (RIA) with the SEC and with state securities regulators. We may only transact business or render personal investment advice in states where we are registered, filed notice or otherwise excluded or exempted from registration requirements. Investment Advisor products are NOT insured by the FDIC, SIPC any federal government agency or Siebert’s parent company or affiliates.

You are being provided this Market Note for general informational purposes only. It is not intended to predict or guarantee the future performance of any security, market sector or the markets generally. This Market Note does not describe our investment services, recommendations or market timing nor does it constitute an offer to sell or any solicitation to buy. All investors are advised to conduct their own independent research before making a purchase decision. This Market Note is to provide general investment education and you are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate for you based on certain investment objectives and financial situation. Do not use the information contained in this email as a basis for investment decisions. You should always consult your investment advisor and tax professional regarding your investment situation before investing. The charts and graphs are obtained from sources believed to be reliable however Siebert AdvisorNXT does not warrant or guarantee the accuracy of the information. Any retransmission, dissemination or other use of this email is prohibited. If you are not the intended recipient, delete the email from your system and contact the sender. This is a market commentary, not research under FINRA Rule 2210 (b)(1)(D)(iii) and FINRA Rule 2210 (c)(7)(C).

© 2021 Siebert AdvisorNXT All rights reserved.